california renters credit turbotax

Renters Credit on TurboTax Did you pay rent for at least half of 2019 on property in California that was your. I saw a lot of recommendations on this sub for FreeTaxUsa and I was worried at first.

Acord Insurance Certificate Template In 2020 Renters In Free Acord Insurance Certificate Template Certificate Templates Card Template Renters Insurance

Renter CreditIncrease Credit Beginning January 1 2019 Author.

. EITC reduces your California tax obligation or allows a refund if no California tax is due. Renter CreditIncrease Credit Beginning January 1 2019 Keywords. A tax credit is a dollar-for-dollar reduction of the income tax you owe.

You can just run through TTCalif again to access the Renters Credit screens. 87066 or less if you are marriedRDP filing jointly head of. Check the box Qualified renter.

Start Your Tax Return Today. Posted by 1 year ago. Some people said TurboTax hand holds you.

Under the Provincial tab select Provincial Tax Credits Profile then make sure to check the boxes Education Property Tax Credit rent paid and the next box Manitoba School. 43533 or less if your filing status is single or marriedregistered domestic partner RDP filing separately. 1 Best answer.

You qualify for the Nonrefundable Renters Credit if you meet all of the following criteria. Fast Refunds Direct Desposit IRS E-File. Have a family with children or help provide money for low-income college students.

To claim the renters credit for California all of the following criteria must be met. Fast Refunds Direct Desposit IRS E-File. Depending upon the CA main form used the output will appear on ine 46 of the.

I dont see anything from the IRS saying there is a limit on how. If you pay rent for your housing. To claim the CA renters credit.

June 4 2019 338 PM. Credit EIC but with different income limitations. Renters Credit on TurboTax.

The rent is paid my dad but my brother and me give him money. For example if you owe 1000 in federal taxes but are eligible for a 1000 tax credit your net liability drops. Ad All Major Tax Situations Are Supported for Free.

Check if you qualify. Claim the Tax Credits Deductions You Deserve. California allows a nonrefundable renters credit for certain individuals.

The program will determine the amount of credit based on the tax return information. Renters earning less than 43533 a year are eligible for a 60 tax credit and renters earning less than 87066 a year who are married and file taxes jointly are eligible for 120. You were a resident of California for at least 6 full months during 2021.

Claim the Tax Credits Deductions You Deserve. Your California adjusted gross. Or on the screen Take a look at California credits and.

Go to Screen 53 Other Credits and select California Other Credits. California Renters Credit SOLVED by Intuit Lacerte Tax 11 Updated August 20 2021 Use Screen 53013 California Other Credits to enter information for the Renters credit. You may qualify if you have earned income of less.

Tax credits help reduce the amount of tax you may owe. Lacerte will determine the amount of. Renters earning less than 43533 a year are eligible for a 60 tax credit and renters earning less than 87066 a year who are married and file taxes jointly are eligible for.

FreeTaxUsa was great and you can import TurboTax details. So if your tax liability is 0 the credit will basically do nothing for you. The taxpayer must be a resident.

I have proof of this through the checks written out to my dad. Although it is nonrefundable the credit amount isnt that big. Start Your Tax Return Today.

Ad All Major Tax Situations Are Supported for Free. For 2020 the California Renters Credit is 60.

Landlord Tenant Notices Rental Property Notices Ez Landlord Forms Being A Landlord Property Management Rental Agreement Templates

2000 Turbotax Basic Intuit Turbo Tax Poirerbta Turbotax Credit Card Application Form Tax Software

Majority Of First Time Home Buyers Have No Idea What It Home Ownership First Time Home Buyers Real Estate Infographic

Month To Months Residential Rental Agreement Free Printable Pdf Format Form Rental Agreement Templates Room Rental Agreement Being A Landlord

Free Rent Landlord Verification Form Word Pdf Eforms Free Fillable Forms Being A Landlord Rental Property Management The Tenant

Turbotax Tax Preparation Software Free Tax Filing Efile Taxes Income Tax Returns Tax Software Free Tax Filing Online Taxes

Browse Our Printable 30 Day Tenant Notice To Landlord Template Being A Landlord Letter Templates Lettering

Renter Profile Being A Landlord Renter Profile

Calendar Month Notice Tenancy Microsoft Word Free Blank Calendar Template Calendar

Month To Month Rental Agreement Editable Rental Agreement Etsy Being A Landlord Rental Agreement Templates Room Rental Agreement

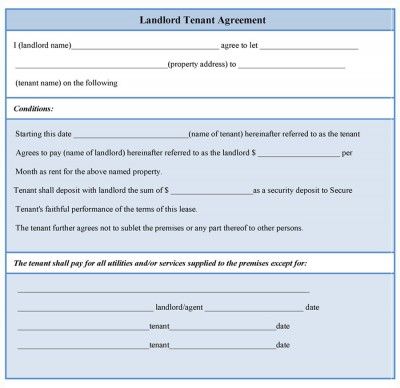

Landlord Tenant Agreement Form Sample Forms Being A Landlord Landlord Tenant Room Rental Agreement

Turbotax Makes Filing Almost Fun Inside Design Blog Turbotax Getting To Know You How Are You Feeling

Browse Our Free 5 Day Notice To Pay Or Quit Template Templates Being A Landlord Quites

Past Due Payment Arrangement Agreement Ez Landlord Forms Being A Landlord Contract Template Rental Agreement Templates

How Turbotax Used Design To Win The Tax Wars Design Design Quotes Education

Fillable Form Commercial Lease Agreement Add Attornment Lease Agreement Leasing Agent Being A Landlord

Renter Profile Being A Landlord Renter Profile

Residential Lease Agreement Template Free Download Blank Rental Intended For Free Residential Leas Rental Agreement Templates Lease Agreement Tenancy Agreement

Taking Tax Return Prep Down To 10 Minutes Tax App Turbotax Mobile App